The growth in mobile phone usage has led to many financial institutions developing their mobile apps for users who want the convenience of 24-hour, anywhere/anytime banking. As per records, of the 1589 million bank account holders, over 122 million people use mobile banking apps. You, too, perhaps no longer visit a bank, but in place depend on the convenience of using your mobile device for banking transactions. But, have you ever thought if a trusted app could steal your personal and financial data? Sadly, the answer is yes.

As per the Threat Report of experts, the last few months have seen a high growth in the incidents of virus attacks on Android mobile banking apps. The Android.Wroba.A malware, named as a banking Trojan, looks like a reliable app but is formed particularly to steal financial and personal data like credit card information, personal information, online banking login credentials, and more.

Consider this, in the past year Experts have found over 10000 Smart phones being attacked by the malware. There are plenty of smart phones that don’t have any security app installed. The malware, by now, would have all the access to the customer’s financial and personal information. Most of us are unaware of these types of attacks, and even when we are aware, we don’t take proper actions to save our privacy until it is too late.

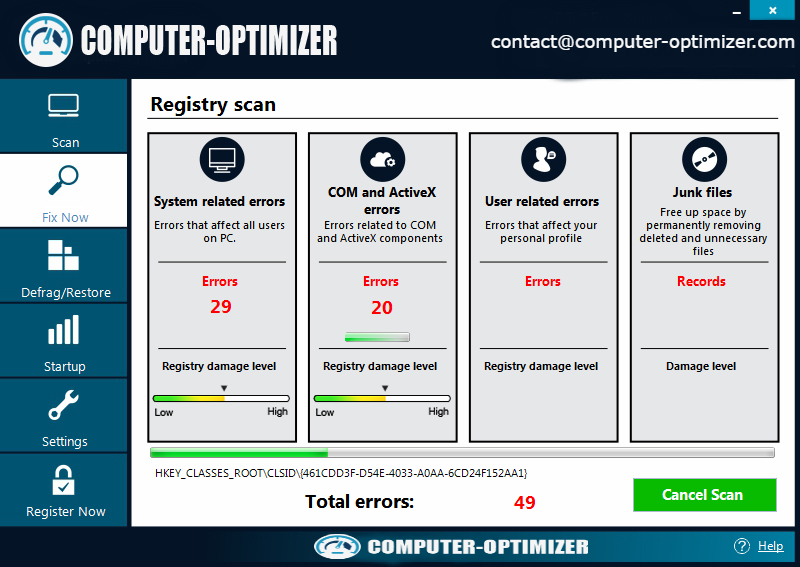

One way to stay away from insecure banking apps is to download apps only from official play store like Google Play. Also, an added layer of safety like Computer Optimizer for Android with advanced features such as virus protection, registry cleaner, device scanning, anti-theft measures, web security, mobile tracker, etc. will help keep you secure. The user interface of Computer Optimizer is very simple to understand and using it is quite simple.